TTO Strategic Communication Tactics with VCs

Natasha Azar, University Relations Manager, OUP

Dec 3, 2020

8 min read

As a VC firm partnered with over 100 universities, we get the question from Tech Transfer Offices (TTOs) all the time — how can we best communicate with VCs?

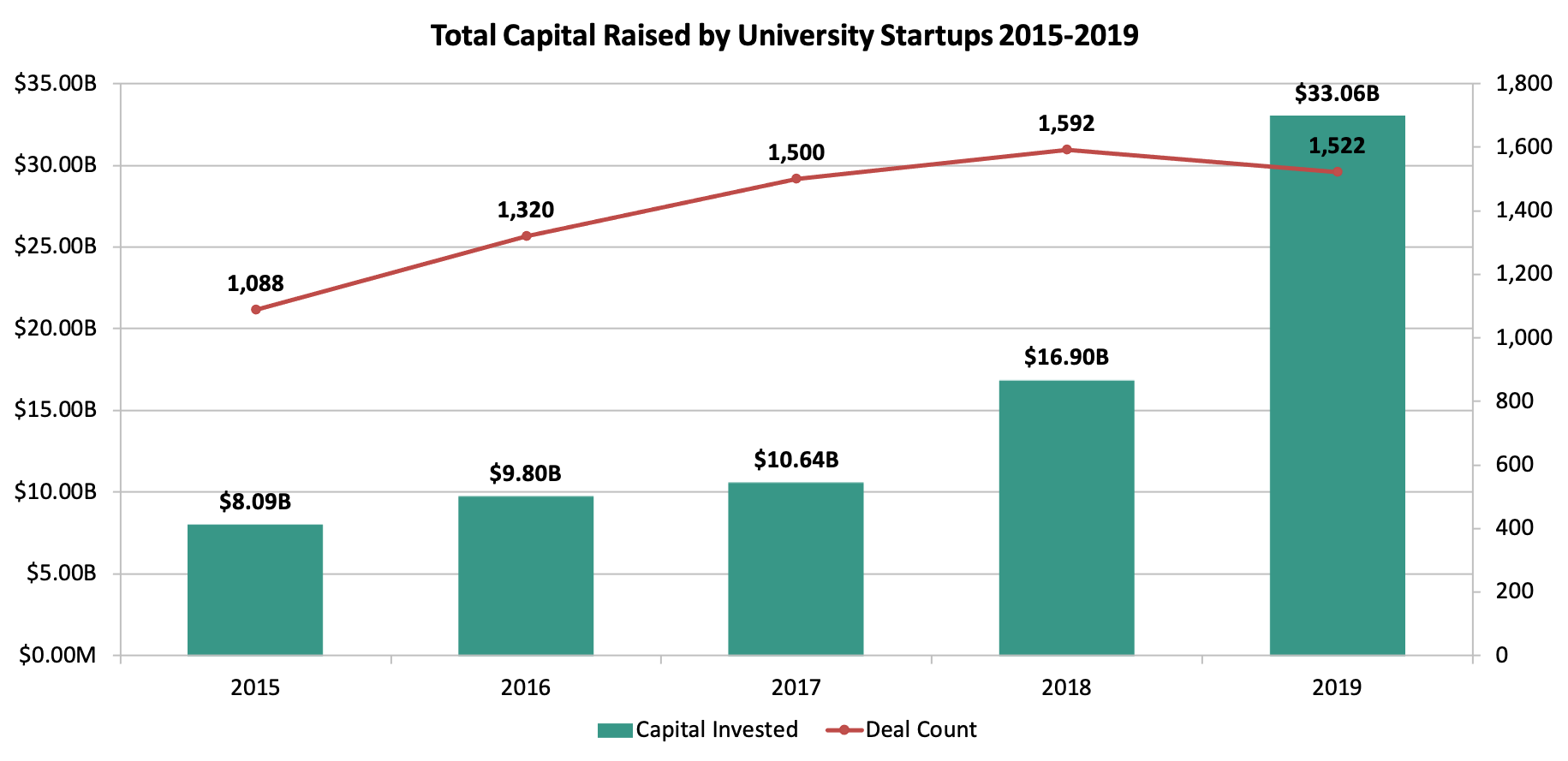

While investors have directed more attention to universities for deal flow in recent years (see bar graph below), most VCs don’t have a singular focus on startups commercializing university research and settle for letting the startups come in via normal channels, e.g. introductions from other VCs, investor conferences, pitching events, and the news. And for institutions that aren’t in the Boston biotech hub, or the Bay area, or New York City, or even other major coastal cities — rising above the noise level of their peers to attract attention from top-tier venture capital, angel, and strategic investors can be a challenge.

So what can TTOs do to attract investors to their university’s startup opportunities? Here are some tips from OUP, with help from Mike Psarouthakis, Venture Center Director at the University of Michigan, and Rob Hallford, Director of New Ventures at Duke University, both of whom recently participated in our webinar in May 2020 entitled ‘Cultivating Relationships with Investors at Your University.’

Curate a List of Investor Contacts

Start with your personal networks. For TTOs that run a Mentor-in-Residence (MIR) program, these individuals are invaluable in introducing investors to your university’s startups. Most MIRs have worked in venture capital or have worked with investors in some capacity.

Not all TTOs have an MIR or EIR network they can tap into. If your university has a Business school, request an introduction to their investor relationships. For Mike and Rob, attending investor-packed events such as JP Morgan, BIO, CES and SXSW Interactive to have one-on-one meetings with VCs and angels is key in building their own networks. Before the events, use your existing network of VCs to broker introductions to others as a way to proactively plan your time.

Another tactic Rob uses to curate his investor list is intentionally targeting Principals and non-partners at VC firms, in particular those in Boston and the Bay area. Junior VCs are more willing to visit a campus outside of a major city to start building relationships with faculty.

Mike develops relationships broadly, and actively uses Pitchbook and LinkedIn to seek out new investors to contact. In Pitchbook he looks at portfolio, capital available, interested sectors, prior co-investors, etc. Capturing this information prior to meeting with investors is valuable in understanding what they’re looking for and how they will engage with the university. LinkedIn is another great tool for uncovering alumni investors.

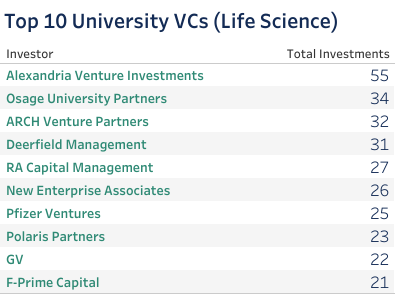

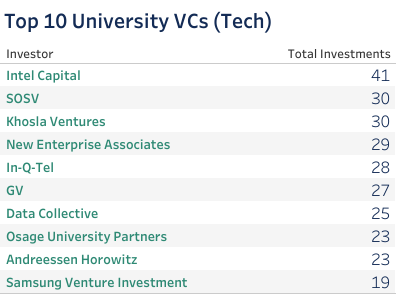

To get an idea of who invests in university spinouts, here is a list of the top 10 VCs investing in both the physical sciences and life sciences space.

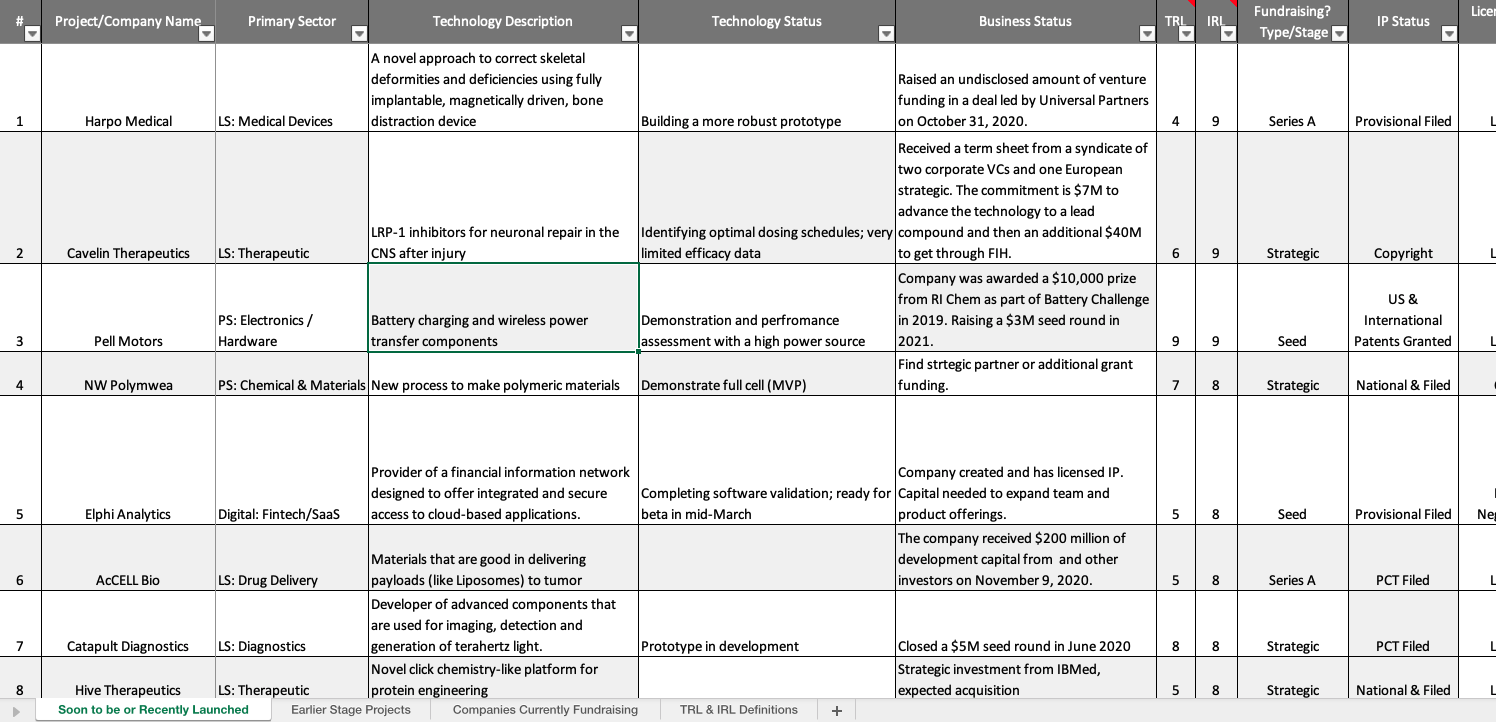

Investor Outreach Management

Michigan utilizes the UM Pipeline report — a spreadsheet created by the University of Michigan to organize their startup pipeline in a consumable format for investors. The pipeline report is sent out quarterly to approximately 500 VC firms, accredited angels, and strategic investors. To be on the list, investors have had at least a soft touch with the office. The 150–170 startup projects currently on the list are segmented into three buckets: early stage projects that are still a year or longer before launch, projects close to launching or those that recently turned into startups, and startups actively fundraising or who expect to be fundraising in the next 12–18 months.

For this last pool of companies, the spreadsheet provides a high overview of the company, the PIs involved, sector, stage, tech readiness level (TRL) and investment readiness level (IRL). Investors can contact these actively fundraising companies directly via the contact information included in the list. For Michigan, this process has opened the door to 6 deals that have closed, and to additional ongoing conversations. Mike uses this report as a tool to communicate the number and variety of opportunities to a large pool of investors at a high level. If you are an academic partner of OUP’s, you can download a template of this document on our Partner Portal here.

Duke implements a phased approach for their startups, and there is a clear distinction between startups in the ‘refinement’ versus ‘venture development’ phases in their pipeline. This way, Rob’s team is showing VCs the projects that are ready and in a format VCs are used to hearing.

With new investors, it’s about understanding what their interests are and hand-picking a few technologies to give a flavor of the work Duke does. Keep in mind that for the most part, investors want to hear about new things.

When to Approach Investors

Like Duke, Michigan works closely with PIs and startup teams to make sure they are represented correctly to VCs. When deciding if a project is ‘VC-ready,’ Mike says it depends on the VC. There are early stage or pre-seed stage investors who are prepared to invest $200K into a company, and there are investors who aren’t interested unless they can invest $5M+ and the technology is further along. In this latter category of large VCs, most are still interesting in getting the startup on their radar early, but may be less responsive to setting up a meeting.

Where some VCs have a specific investment threshold, others have management team requirements before considering a deal. As a TTO, it’s important to know your investors before sending them deals. Some VCs will invest in a startup where there is only a technical founder in place and not an outside CEO, where others won’t consider an deal without a CEO in place.

At Duke, the New Ventures team keeps a handful of investors close to them. Before casting a wide net, Rob will reach out to a smaller ‘safe’ group of contacts to get initial feedback and avoid showing a large group of top-tier investors a project without enough data.

Deciding what is ‘VC-ready’ depends on current market trends, the industry, and the faculty member behind the project. What’s a hot area attracting VC attention? Who are the sought-after faculty? The worst that could happen is a VC turns the opportunity down because the story wasn’t told effectively.

TTOs have the added challenge of deciding whether to act as a ‘screener’ and send a small number of quality deals to VC contacts, versus sending everything in their pipeline. There are arguments for and against each of these methods. At OUP, we find it more effective when TTOs filter deals and send what they deem to be the most investable opportunities.

When a VC Wants to Interact with a Company

When a VC expresses interest in one of your university’s companies, provide them screening material in the form of a pitch deck where possible. If a presentable pitch deck isn’t available, have a succinct paragraph prepared to send that describes the team’s background, the technology, and market. Avoid sharing white papers or business plans with a potential investor — these will not articulate the startup’s story in an investor-friendly format.

As a TTO applying office resources to VC outreach efforts, it is tempting to insert oneself into the discussions or follow up with the VC for feedback and metrics tracking. However, in the early days of a new VC relationship, most investors would appreciate a low friction experience where they can communicate directly, and only, with the startup. At the end of the diligence process, a VC will let the company know their investment decision; don’t expect a VC to contact the TTO to provide the same feedback, if not only because some VCs may think of the startup and the TTO as a unified entity. As a relationship grows with an investor, the natural progression may lend itself to the TTO being more involved in the process.

On average, a large institutional VC is not going to find more than a few startups each year from your institution that perk their interest. The stage of most TTO-driven startups is earlier than VCs operate, so it may be a rare event that they want to connect. If they do, it could genuinely be for an investment, or it may be to get smarter on a space, or to start tracking a company for a more substantial round. It is also normal for these early VC interactions to be with associates and analysts from the firm, so do not expect partners to inquire about a company or join the first calls with a company.

Attracting Investors to Events

Investor-focused events are an effective way to shine a light on your startups and capture VC interest. TTOs should be encouraged to set up meetings when investors are on campus for events such as pitch competitions, showcase days, etc. Rob recommends also taking advantage of investor presence on campus to set up meetings with faculty who are earlier in their startup process.

Not all VCs are going to be willing to travel to campus. “But investors who do make the time to visit and provide good feedback to our startups are the ones who get first look at startup opportunities,” according to Rob. Relationship building with investors in a COVID world might prove easier with business travel still suspended for many. TTOs may have more success contacting VCs (especially junior VCs) and getting them to attend virtual events.

Duke’s Venture Days are invite-only. Limiting the audience and not allowing service providers makes the event just about investors and investable deals. Rob markets them directly by talking in person with investors while at JP Morgan and other events.

For UM, the launch of a regional investor event, the Midwest Growth Capital Symposium, has raised the profile for startup activity in the Midwest and brought non-regional alumni VCs to the state of Michigan. Regional investors benefit from this event too, as they can engage with non-regional VCs from the major tech hubs without having to travel.

Measuring Success of Your Investor Introductions

For Duke, it depends on feedback they receive from investors. The piece of feedback most often heard is that the technologies are very early. People who invest in university spinouts understand this reality, but there could be a long lag time between making an investor introduction and seeing a measurable outcome.

Re-engagement is a key metric for Mike. If a fund maintains contact with a startup, this is a quantifiable ‘success’ even if the fund doesn’t eventually invest. Similarly, if a fund makes an introduction to another investor, this is also named a success to the Venture Center Team. This means the pitch was compelling enough to put their reputation on the line to introduce to another investor connection.

In many ways, the VC-TTO relationship is similar to the relationship between two VCs. As the VC-TTO relationship grows and trust builds, so will the rate of communication between the two entities in a way that drives a strong flywheel for increased activity amongst the two groups.